Management International Review volume 61, pages 745–767 (2021)

Abstract

We examine the effect of R&D on foreign subsidiaries’ productivity performance. We argue that both local R&D expenditures in the subsidiary and R&D conducted in the wider network of the multinational enterprise (MNE) for the subsidiary improve productivity but that their respective roles depend on whether the host country of the subsidiary is at or below the global technology frontier. Local R&D is more effective if the host country is at the frontier, while R&D conducted in the MNE network is more effective if the host country is behind the frontier. In the latter case, both types of R&D are complementary and reinforce each other’s effect on productivity performance. We test hypotheses on fine-grained longitudinal micro data on affiliate productivity and R&D investments. We estimate dynamic productivity models controlling for endogeneity and allowing for declining returns to R&D and productivity convergence.

Introduction

Traditionally, the technological advantages of multinational enterprises (MNEs) are developed at home, where most of the R&D activities are concentrated (e.g., Berry, 2014), and then transferred to foreign subsidiaries. Subsidiaries conduct R&D to assimilate and adapt home based technological assets to the characteristics of their local market (Kuemmerle, 1997, 1999). Once successfully integrated, parent firm know-how helps subsidiaries to establish a competitive advantage in the local market (Buckley & Casson, 1976; Caves, 1996; Delios & Beamish, 2001; Dunning, 1993; Fang et al., 2007, 2013; Hymer, 1976; Martin & Salomon, 2003; Un, 2011) compensating for possible ‘liabilities of foreignness’ that arise from unfamiliar business environments (Zaheer, 1995).

At the same time, however, knowledge production has become increasingly globalized, with research hubs emerging around the world (Alkemade et al., 2015; Furman et al., 2002; Liu & Chen, 2012; OECD, 2016). R&D performed by MNEs’ local subsidiaries gains more prominence and subsidiaries gain more important R&D mandates, as firms seek to gain access to the valuable tacit and advanced knowledge present in host countries (Berry, 2006; Cantwell & Janne, 1999; Castellani et al., 2017; Driffield et al., 2016; Singh, 2007; Song & Shin, 2008). Conducting R&D in subsidiaries in host countries at the global technology frontier may have distinct advantages over R&D conducted by the MNE at home or elsewhere in the MNE’s network.

It follows that R&D investments by the subsidiary, on the one hand, and R&D investments and knowledge transfer by the MNE, on the other hand, will have differential importance in the subsidiary depending on the relative advanced nature of the environment for innovation in the host economy, with subsidiaries taking on different roles in terms of knowledge exploitation or knowledge sourcing and augmentation (Papanastassiou et al., 2019, p. 646). Surprisingly, extant research has not examined the joint consequences of these two sources of technology development and innovation for subsidiaries in detail. The literature has primarily focused only on the effects of R&D and the knowledge stock of the parent firm on subsidiaries (e.g., Almeida & Phene, 2004; Delios & Beamish, 2001; Fang et al., 2007, 2013; Phene & Almeida, 2008) or on the effect of overseas R&D and internationalization on parent MNE performance (Belderbos et al., 2015; Castellani et al., 2017; Driffield et al., 2016; Kafouros et al., 2008). Yet MNEs have to decide on the allocation of R&D investments at home and abroad, and preferably such allocation results in synergies between these R&D activities to enhance the competitiveness of foreign subsidiaries.

In this paper, we contribute an analysis of the joint and interactive effects of subsidiary R&D and R&D conducted by the MNE for the subsidiary on subsidiary performance. We start from the notion that innovation and subsidiary performance rely on frontier knowledge and technologies that need to be applied to local contexts, and that subsidiaries that are better able to integrate these different types of knowledge will exhibit greater performance (e.g., Belderbos et al., 2015; Michailova & Zhan, 2015; Scott-Kennel & Giroud, 2015; Un & Rodríguez, 2018). We argue that R&D conducted for the subsidiary in the MNE network and subsidiary R&D can reinforce each other’s impact on subsidiary performance, as R&D conducted in a subsidiary allows it to build up the necessary capabilities to effectively apply the know-how and expertise of the MNE and the results of R&D conducted for the subsidiary in the wider MNE network, and to combine local knowledge with MNE knowledge. In addition, we argue that it is crucial to make a distinction between subsidiaries active in an industry in which the host country is at the global technology frontier and subsidiaries in industries in which the host country is lagging behind (García-Sánchez et al., 2017; Salomon & Jin, 2008; Smith, 2014). We develop hypotheses on how subsidiaries benefit differently from their own R&D investments, R&D conducted by the MNE for the subsidiary, and their interactive effect, due to differences in the local host country environment. We confirm that local subsidiary R&D is more effective if the host country is at the technology frontier, while R&D by the MNE is more effective if the host country is behind the frontier. Only in the latter case, both types of R&D reinforce each other’s effect on the performance of the affiliate.

We test hypotheses on unique and fine-grained longitudinal data on R&D investments of foreign subsidiaries and R&D investments conducted by the MNE for the subsidiary, drawing on a dataset covering a large panel of 1756 foreign subsidiaries based in the Netherlands and active in multiple industries. A rare characteristic of these data is that it allows identifying R&D investments in the MNE network that are conducted specifically for a focal subsidiary. We measure performance as subsidiary productivity. Productivity is the efficiency with which capital and labor inputs are utilized to create firm value. It can be considered a direct function of technological change and innovation driven by R&D investments (Castellani et al., 2017; Driffield & Love, 2007; Griffith et al., 2006; Hall et al., 2012; Smith, 2014), which makes it an appropriate measure in a study focusing on the effects of R&D. We test differential effects of subsidiary and MNE R&D by exploiting variation across industries in the position of the Netherlands as being at, or below, the technology frontier.

Our study contributes to the literature on R&D internationalization by MNEs by showing that both subsidiary and MNE R&D investments have to be taken into account to study subsidiary performance, but that their effects and complementarity crucially depend on the host country’s relative technological strength. By highlighting the specific conditions under which complementarities within the MNE’s R&D network are likely to occur, we suggest an important potential boundary condition to earlier studies of knowledge complementarities in MNEs focusing on intra-firm licensing and affiliate R&D (Belderbos et al., 2008) and affiliate R&D and parent firm managerial knowledge (Berry, 2015). Our findings also add to the stream of literature investigating the consequences of the host country position in the international technological landscape, which has focused on directions of international knowledge flows (e.g., Cantwell & Janne, 1999; Singh, 2007), parent firm performance (Belderbos et al., 2015) and exports (Salomon & Jin, 2008; Smith, 2014), but has not examined foreign subsidiary performance. Our study answers to the call by Papanastassiou et al. (2019, p. 648) to examine the heterogeneous relationship between R&D configurations of MNEs and the geography of innovation.

Background and Hypotheses

The expansion and success of MNEs into new geographic markets often rests on the possession of specific ‘ownership advantages’ which give MNEs a competitive edge over local rival firms (Buckley & Casson, 1976; Caves, 1996; Dunning, 1993; Hymer, 1976; Teece et al., 1997). According to the knowledge-based view of the firm, knowledge that is rare, and difficult to imitate is central to the formation of these competitive advantages (Grant, 1996). Firms accumulate knowledge, especially technological knowledge, by investing resources in R&D activities. Through R&D efforts, firms developed intangible proprietary assets in the form of new products, improved production processes and acquired technical expertise, and as such can enhance value creation and productivity.

Among all MNEs’ value-chain activities, R&D remains the last to be internationalized substantially (Belderbos et al., 2013; Berry, 2014) with an appreciable share of R&D activities still conducted in the home country of the firm. Firms tend to maintain R&D centralized to maximize economies of scale and scope that characterize technology production at the firm level (Edler et al., 2002; Hewitt, 1980), while minimizing the risk of knowledge leakages to foreign competitors (Alcácer & Zhao, 2012; Singh, 2007).

The way MNEs generate value from knowledge has been traditionally viewed as a unidirectional process: Home base R&D was creating the knowledge assets that were then transferred to foreign subsidiaries and exploited in new geographic markets (Buckley & Casson, 1976). Subsidiaries conducted R&D to adapt processes and product to local market and manufacturing circumstances, in what is coined ‘home base exploiting R&D’ (Kuemmerle, 1997) or ‘asset exploiting R&D’ (Papanastassiou et al., 2019). The performance of foreign operations was ultimately dependent on knowledge developed at home. By successfully acquiring parent firm knowledge-based competitive advantages, newly established subsidiaries were able to overcome potential liabilities of foreignness occurring from operating a business in a new and unfamiliar environment (Zaheer, 1995).

In the last two decades, however, knowledge has become increasingly global: Technological specialized clusters and centers of excellence have emerged around the world across multiple industries (Furman et al., 2002). Consequently, the persistence of home country technological dominance is less evident. Knowledge-based competences and expertise drawn exclusively from R&D activities at home are no longer be sufficient to sustain the competitive advantage of MNEs’ foreign operations in particular if they operate in technologically advanced countries. The conventional process of MNE’s value creation from knowledge is increasingly inverted as MNEs are able to improve processes and develop new products by sourcing knowledge from abroad via ‘reverse knowledge transfer’ (Ambos et al., 2006; Driffield et al., 2016; Frost & Zhou, 2005; Håkanson & Nobel, 2000; Rabbiosi, 2011; Un & Cuervo-Cazurra, 2008). Subsidiary’s R&D mandate covered global development and subsidiary R&D is geared to augment the knowledge base of the MNE in what is coined ‘home base augmenting’ or ‘asset augmenting’ R&D (Kuemmerle, 1997; Papanastassiou et al., 2019). Extant literature has provided abundant evidence of subsidiaries investing in R&D to build knowledge assets and source local know-how in the host country (Asakawa, 2001; Berry, 2006; Cantwell & Mudambi, 2005; Singh, 2007; Song & Shin, 2008; Tsang & Yip, 2007). These two purposes of R&D have different consequences for the role of R&D in driving subsidiary productivity performance, on which we hypothesize below.

Technology development is widely understood as a cumulative process highly dependent on the specific geographic context. Technological expertise and innovations tend to originate and grow within a limited geographic area that permits complex knowledge and ideas to be transmitted and shared in the local scientific community via frequent face-to-face interactions (Audretsch & Feldman, 1996; Saxenian, 1994). As knowledge spillovers remain to a large extent geographically bounded (Jaffe et al., 1993; Singh, 2007), innovation activities are likely to concentrate in regional technological clusters and benefit from agglomeration economies (Chung & Alcácer, 2002). The cumulative nature of technology leads to a ‘path-dependence’ behavior that fosters further spatial technological specialization (Arthur, 1989; Cantwell & Janne, 1999). Depending on their pre-existing knowledge base, different countries assume specific technology profiles and become leaders in different industries (Furman et al., 2002).

If an MNE subsidiary is active in a country operating at the global technology frontier, it can create value by absorbing local external knowledge. The subsidiary takes on a ‘home base augmenting’ or ‘asset augmenting’ role in the MNE network (Kuemmerle, 1997). Local knowledge sourcing is crucial in these environments in order to compete with local leading firms and to develop a product offer that satisfies sophisticated and highly demanding local customers. Subsidiaries in technologically advanced countries can develop specific competences by working closely with productive suppliers and customers, establishing collaborations with local universities, starting joint R&D projects with local firms or hiring local specialized engineers to work in their facilities (Almeida & Kogut, 1999; Griffith et al., 2006; Un & Rodríguez, 2018). Local sourcing and collaboration activities tend to be more intensive in advanced local innovation environments (e.g., García-Sánchez et al., 2017).

These knowledge sourcing strategies require subsidiaries to develop local internal R&D capabilities to become a credible R&D collaboration partner and to evaluate, absorb and integrate relevant knowledge from advanced local sources in their innovation efforts (Cantwell & Mudambi, 2005; Cohen & Levinthal, 1990; García-Sánchez et al., 2017; Penner-Hahn & Shaver, 2005; Song et al., 2011; Un & Rodríguez, 2018). Hence, subsidiaries’ local R&D investments will be important and effective in improving their productivity performance in advanced innovation environments.

In contrast, when the host country is lagging behind the technology frontier and does not offer a subsidiary valuable opportunities to enhance knowledge sourcing and technological capabilities, the subsidiary will turn to the MNE network (Almeida & Phene, 2004; García-Sánchez et al., 2017; Scott-Kennel & Giroud, 2015) and will take on a ‘home based exploiting’ or ‘asset exploiting’ role (Kuemmerle, 1997). The MNE’s managerial and coordination capabilities and intra-MNE knowledge exchange allow subsidiaries to draw on internal knowledge that would be difficult or costly to acquire externally (Bartlett & Ghoshal, 1989; Hedlund, 1994; Kogut & Zander, 1993). Competences and expertise acquired by the MNE at home and elsewhere that are at the global industry technology frontier can help a focal subsidiary in countries behind the technology frontier to develop products and processes that outcompete those of local rivals (Criscuolo et al., 2010; Zeschky et al., 2014). Hence, innovation and productivity will be more dependent on knowledge available in the MNE network than on local knowledge, and it is R&D conducted in the MNE network for the subsidiary that is expected to have performance advantages.

The arguments above suggest that the productivity benefits of subsidiary R&D and R&D conducted in the MNE for the subsidiary will depend on the relative technological strength of the host country. Such technological strength differs across industries because it is a function of host country industry and technological specialization and the presence of local innovation clusters (Arthur, 1989; Cantwell & Janne, 1999; Chung & Alcácer, 2002; Furman et al., 2002). Subsidiary R&D is more important for subsidiaries located in a leading host country industry environment, while R&D activities conducted in the MNE network is more important in a technologically lagging industry environment. We formulate:

Hypothesis 1: Subsidiary R&D is more effective in improving subsidiary productivity if the host country industry is at the global technology frontier, while R&D conducted in the MNE network for the subsidiary is more effective in improving subsidiary productivity if the host county industry is lagging behind the global R&D frontier.

There are two related reasons why both subsidiary R&D and R&D conducted in the MNE can possibly reinforce each other’s effects on performance. The first is the general absorptive capacity argument (e.g., Cohen & Levinthal, 1990). Not only for external knowledge sourcing but also for effective knowledge transfer across units within the MNE, an absorptive capacity to understand, assimilate and exploit knowledge transferred is important for innovation (e.g., Belderbos et al., 2015; Gupta & Govindarajan, 2000). Although the advantage of the MNE is that it can transfer knowledge across borders internally to improve its competitive position in the countries in which it operates, knowledge developed within the MNE in one location still has to be absorbed, integrated, and operationalized by the MNE units elsewhere to reap performance benefits. Hence, both subsidiary R&D and R&D performed in the wider network of the MNE are likely to be simultaneously important for productivity performance.

Second, productivity increases typically require the combination of frontier technologies and the application of these technologies to local markets and manufacturing conditions, of which knowledge and expertise resides in local units. For instance, car manufacturers may develop their basic technologies on engines and aerodynamics at home but also have local R&D units abroad to adapt engine specification and car design to local tastes and environmental regulations. In any given location, additional technology development and adaptations are often needed to apply foreign technology to the specific characteristics of a local market (Kuemmerle, 1997). Technological frontier knowledge developed in a specific R&D unit of the MNE can be combined with local R&D in other units of the MNE to allow these units to cater to specific local demands or to enable the use of specific local input variants and manufacturing conditions. If the focal subsidiary is the source of frontier knowledge, then the MNE can combine this with dedicated R&D elsewhere in the network focusing on the application of this knowledge to other markets. Likewise, if the focal subsidiary does not have access to frontier knowledge locally but relies on knowledge transferred from within the MNE network, subsidiary R&D will allow for productivity enhancing development of applications to the local environment. This suggests again that R&D conducted in the MNE network and local subsidiary R&D are likely to be complements and to reinforce each other.

We argue that such complementarity is most salient in increasing subsidiary productivity performance if the host country industry environment is lagging the global technology frontier, rather than being at this frontier. If the subsidiary operates in a host country that is at the global technology frontier, R&D performed in the MNE network has less to offer to the subsidiary in terms of technologies to be refined or combined with local knowledge. By implication, there will also be less effort required by the subsidiary to absorb and use knowledge from the MNE in its operations. This is not to say that the combination of MNE and subsidiary R&D is not important for the MNE, yet this complementarity is more likely to be effective in reaching the objective of increasing productivity benefits elsewhere within the MNE rather than in the focal subsidiary. Subsidiary R&D, in a home based augmenting and reverse knowledge transfer logic, is then combined with dedicated R&D elsewhere in the MNE to apply the subsidiary’s advanced knowledge to local circumstances in the home country of the MNE or in third countries (e.g., Driffield et al., 2016; Håkanson & Nobel, 2000; Rabbiosi, 2011; Tsang & Yip, 2007; Un & Cuervo-Cazurra, 2008).

This contrasts with the joint roles of subsidiary and MNE R&D in local industry environments lagging the technology frontier. Here access to advanced knowledge requires knowledge transfer within the MNE network and relies on R&D conducted within the MNE in more advanced innovation environments. Investments in local R&D in the subsidiary focusing on ‘home based exploitation’ R&D allow the subsidiary to combine this MNE knowledge with local knowledge to adapt process and products to local circumstances and enhance productivity. The more advanced nature of knowledge available in the MNE network, with R&D in the MNE network drawing on more advanced technology environments,Footnote 1 makes it essential that the subsidiary develops a sufficient absorptive capacity by investing in R&D, to exploit and adapt this knowledge to its local operations.

The above arguments suggest that the complementary relationship between subsidiary R&D and R&D conducted in the MNE network for the subsidiary in enhancing subsidiary productivity performance is likely to be stronger in those industries in which the host countries is lagging the global technology frontier:

Hypothesis 2: Subsidiary local R&D and R&D conducted in the MNE network for the subsidiary have a stronger complementary effect on subsidiary productivity if the host country industry is lagging behind the global technology frontier than if the host country industry is at this frontier.

Data, Variables, and Empirical Model

We draw on unique unpublished micro panel data from the Netherlands’ Central Bureau of Statistic (CBS) official annual R&D surveys matched with production statistics on firms with more than 10 employees operating in the Netherlands. For the purpose of our research, we focus on firms that have a foreign owner and are under foreign control. We have access to data covering the years 1995 to 2003. Since smaller firms are randomly sampled in each year, we do not always have data for each year. In practice, this leads to unbalanced panel dataset where subsidiaries are observed on average for four consecutive years. This number reduces to two in final regressions we employ due to the use of the lagged dependent variable in the dynamic specification of the model and due to the estimation with GMM using lagged variables as instruments to control for potential endogeneity. The final sample is composed of 3564 observations on 1751 foreign subsidiaries.

We take subsidiary productivity, net value added per employee, as performance measure, following earlier studies (Belderbos et al., 2015; Castellani et al., 2017; Driffield & Love, 2007; Driffield et al., 2016; Smith, 2014; Todo & Shimizutani, 2008). Productivity measures the value created through the efficient use of capital and labor inputs. It is generally regarded as being a function of the firm’s knowledge base, which is driven by cumulative R&D investments (e.g., Belderbos et al., 2015; Hall et al., 2012). Hence, productivity has a more direct relationship with a firm’s product and process technology than other performance measures such as market value or accounting profits, which focus on benefits to shareholders. It reflects cost-reducing effects of R&D as well as the effects of new product development on price–cost margins. We derive the productivity model from a production function in which subsidiary value added is a function of labor, capital, and the knowledge stock driven by R&D investments.

The core explanatory variables are subsidiary R&D investment and R&D investment by the MNE. For MNE R&D, we can rely on a precise measure of R&D by the parent or by other subsidiaries specifically conduced specifically for, and financed by, the focal subsidiary in the Netherlands. This information derives from a question in the R&D survey asking for the amount of R&D conducted for the subsidiary by other units in the MNE network. Other variables included in the model are fixed capital and employment (expressed in full time equivalents). Capital, R&D, and values added are measured in constant prices. The models also include 9-year dummies and 28 Industry dummies.

In addition, we include two control variables that may affect productivity. We include a variable measuring the investments in ICT in the industry, using information from the EU KLEMS Growth and Productivity Accounts database prepared by a consortium of 24 research institutes and national statistical institutes on behalf of the European Commission.Footnote 2Information on ICT investments drawing on this source have been used by researchers to study output and productivity growth and to analyze sources of cross-country differences in productivity (e.g., Aghion et al., 2005; O’Mahony & Vecchi, 2009). Second we include a variable controlling for the level of embeddedness of the foreign subsidiary in the local innovation system (e.g., García-Sánchez et al., 2017; Isaac et al., 2019; Un & Rodríguez, 2018). Since our data draw on R&D surveys rather than innovation surveys, we do not have information on R&D collaboration at our disposal, but we can utilize information on outsourcing of subsidiary R&D to local partners. Specifically, local embeddedness measures the share of subsidiary R&D that is subject to such outsourcing.

We make use of variation across industries to determine if the relevant host country (industry) environment of the subsidiary can be characterized as either being at, or lagging behind, the global technology frontier. We identify a leading (lagging) industry if the industry R&D intensity in the Netherlands falls within (below) the OECD the top 33% of OECD countries. This approach has been used in prior literature (Belderbos et al., 2015; Griffith et al., 2006; Salomon & Jin, 2008) and is based on the idea that the higher is the relative intensity of the local industry R&D, the more subsidiary R&D can benefit from knowledge sourcing and spillovers. Given the relatively advanced status of the Netherlands economy and innovation infrastructure, a relatively large share of subsidiaries are observed in leading industries, as shown in Table 1. About 42% subsidiary observations relate to leading industries. Leading industries include food, office machinery, (electrical) machinery and wholesale; lagging industries relative to other OECD countries include textiles, wood, chemical and rubber. For some industries, such as business service, the status changes during the period.

The empirical model is based on a knowledge stock augmented Cobb Douglas model (e.g., Hall et al., 2012). Value added generated by a subsidiary is a function of labor, capital stock, and foreign and domestic R&D stocks. For firm i at time t:

(1)

(1)where Y is output, C is the physical capital stock, L is labor input, and is the knowledge (R&D) stock. K is a function of investments in subsidiary and MNE R&D. The constants 𝛼𝑖αi reflect firm-specific (organizational and managerial) capabilities. The parameter 𝜎𝑖𝑡σit is a time-variant firm-specific efficiency parameter, which also depends on past productivity to allow for convergence in productivity over time (Klette, 1996). The knowledge stock K improves value add over and above the effects of capital and labor input, and hence positively affects the productivity of the subsidiary.

From Eq. (1) we derive the model for estimation through a few more steps, described in the Appendix. We divide by labor, take logarithms and difference the equation to arrive at a productivity growth specification. In this growth specification, firm fixed effects 𝛼𝑖αi drop out and growth in the knowledge stock can be captured by R&D investments:

(2)

(2)Small letters denote variables in natural logarithms, 𝑞𝑖𝑡qit is labor productivity, Δ𝑖𝑖𝑡Δiit representsrepresentsthe growth in fixed capital investment, Δ𝑙𝑖𝑡Δlit is the growth in labor, and Zit are additional control variables that may have an influence on productivity growth. The variables 𝑟𝑠𝑢𝑏𝑠(𝑖𝑡−1)r(it−1)subs and 𝑟𝑀𝑁𝐸𝑖𝑡−1rit−1MNE represent the R&D expenditures of the subsidiary and the MNE, respectively, and are divided by value added to express them as an intensity. In addition to the interaction effect between subsidiary and MNE R&D to test hypothesis 2, the model includes their square terms to allow for declining returns to scale in R&D. This is an important feature of the model, since prior research has suggested that there are declining marginal returns to R&D (e.g., Acs & Isberg, 1991; Belderbos et al., 2015; Cohen & Klepper, 1996). Not controlling for this feature may lead to biased estimates on the crucial interaction term of subsidiary and MNE R&D.Footnote 3The equation includes year-specific intercepts 𝜆𝑡λt, a firm specific random effect 𝑣𝑖vi in addition to a an error term 𝜇𝑖𝑡μit.. Hence, even in terms of growth, we allow for time invariant unobserved firm characteristics that may play an idiosyncratic role in determining productivity outcomes.

We estimate (2) in level terms, by bringing the lagged productivity term to the right had side of the equation. This allows us to apply well established robust generalized method of moments (GMM) techniques that are conventionally conceived in level terms. We estimate Eq. (1) with GMM, instrumenting the variables of interest with lagged variables to control for endogeneity. GMM is suitable in empirical designs with dynamic panel data with a short time dimension (Kripfganz, 2016). It estimates a system of equations that includes a level equation, where level variables are instrumented with their lagged first differences, and a first differenced equation, where the instruments used are the lagged level values. The lagged level and differences are orthogonal to the error term and thus represent valid instruments (Blundell & Bond, 1998). In the level equation, year and industry dummies and individual random effects are included. GMM is the model of choice when the presence of a lagged dependent variable creates an endogeneity issue and allows for consistent estimates in the presence of autocorrelation and heteroscedasticity (e.g., Alessandri & Seth, 2014; Kripfganz, 2016).

We test differential effects of subsidiary and MNE R&D contingent on position of the host country industry with respect to the global technology frontier, by estimating separate models for the subsamples of subsidiaries operating in leading vs lagging industries. Split sample analysis allows testing for differences in the effects of R&D types as R&D coefficients, together with all other coefficients, are allowed to vary between leading and lagging industries (Belderbos & Zou, 2009; Belderbos et al., 2015; García-Sánchez et al., 2017; Hoetker, 2007).Footnote 4

Results

Table 2 reports the descriptive statistics of the variables for each subsample: leading industries at the global technology frontier and lagging industries behind the frontier, together with their pairwise correlations. Subsidiaries report almost equal productivity in the two groups, but we note that productivity averages also depend on other factors such as fixed capital intensity. Subsidiaries’ R&D intensity is higher in leading industries, while the intensity of MNE R&D is higher in lagging industries. This is in line with our theoretical arguments to the extent that one would expect more R&D to be conducted where it is expected to have the most pronounced performance effects. The correlation levels similarly do not seem to indicate multicollinearity. The correlation between the dependent variable and the lagged dependent variable is high (0.75–0.78), as one would expect, but with correlation levels suggesting that there is considerable room to shift for yearly productivity shifts due to R&D investments. The VIF factor is 4.71 on average, with the highest individual score at 6.94. These scores do not indicate multicollinearity concerns, as they are below the cutoff point of 10.

Table 3 reports the results for the GMM estimation. Model 1 includes all foreign subsidiaries, Model 2 only the subsample of subsidiaries active in lagging industries behind the global technology frontier and Model 3 the subsidiaries in leading industries. The exogeneity of the instruments is not rejected by the Hansen test statistic, which indicated the validity of the instruments.

In model 1, the past labor productivity has an estimated coefficient of 0.65, which indicates that approximately two thirds of the productivity advantage remains over a year. We see a stronger persistence in productivity differences for leading industries (0.70) compare to lagging industries (0.57). Employment and fixed capital investment are significant. The positive linear and negative squared terms of subsidiary R&D and MNE R&D show that there are declining returns to R&D (see below). The significant interaction term indicates a complementarity between the two R&D expenditures. We do not find significant influences of the ICT and local embeddedness control variables.

Examining the estimates for the subsamples in models 2 and 3, we find that in industries at the global technology frontier, subsidiary R&D and its square term are significant, while in lagging industries only MNE R&D and its square term are significant, in support of hypothesis 1. A positive and statistically significant interaction effect between subsidiary and MNE R&D is observed in lagging subsidiaries, but not in leading industries, which supports hypothesis 2.

Although the significant negative coefficient of the quadratic term of subsidiary R&D in leading industries suggests declining returns to R&D, this is only mildly so. The turning point of R&D over value added can be derived as 3.9—well beyond the values of subsidiary R&D intensity observed in the sample. In lagging industries the effect of MNE R&D reaches its top at 0.19, which is at the end of the range of observed values. The steeper curve of the MNE R&D may suggest that there are stronger limits to the knowledge that can be coordinated and transferred across geographic distance, reducing the potential economies of scale of R&D in the MNE conducted for the subsidiary.

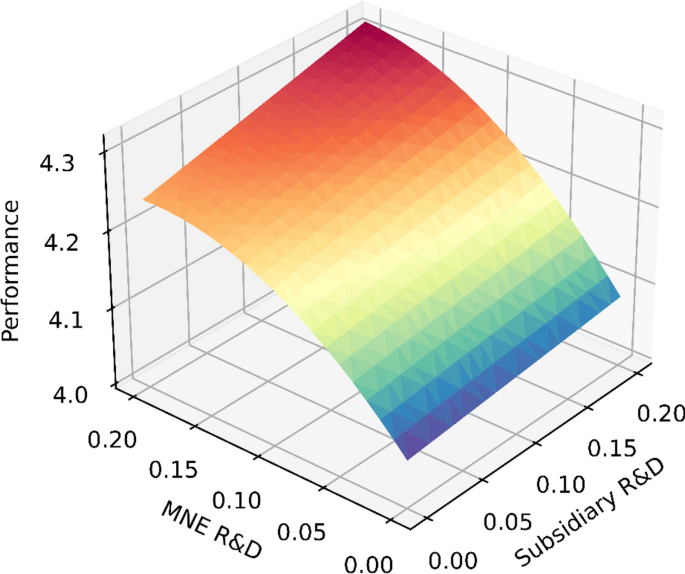

In lagging industries, the coefficients of subsidiary R&D are not significant, suggesting that local R&D alone does not contribute to productivity unless it is complemented by MNE R&D. It can be calculated that the marginal effect of subsidiary R&D becomes statistically significant when MNE R&D is above 0.05. Figure 1 plots the combined predicted effect of subsidiary R&D and MNE R&D on productivity in lagging industries, taking into account also the positive coefficient of the interaction term. The graph illustrates the value of combining the two types of R&D. The subsidiary productivity increase along the subsidiary R&D dimension is steeper at higher levels of MNE R&D. The marginal effect of subsidiary R&D becomes statistically significant when MNE R&D is above 0.05 and continues to increase if it is combined with higher levels of MNE R&D.

We conducted a number of supplementary analyses to examine the robustness of our findings. First, although previous studies indicates that most of the R&D effect on productivity occurs within one year (Hall et al., 1986; Klette & Johansen, 2000), we examined if knowledge stock represented by R&D would affect productivity with a longer lag. Applying a two year lag, we lose one year of R&D and moreover, because we have an unbalanced panel, the requirement of another adjacent year of R&D observations leads to the omission of quite a few additional observations. Observations drop from 3564 to 1980. We found similar effects, with effect sizes somewhat smaller, suggesting that the one year lag is the most robust approach.

Second, we examined if the patterns for lagging industries were perhaps more pronounced for industries only reach the bottom 33% of the OECD average. However, given the relatively advanced nature or the economy of the Netherlands, this only left 101 observations. With these limited degrees of freedom, the complex GMM model with square and interaction terms was difficult to identify, and results showed high standard errors and insignificance for the focal variables.

Discussion and Conclusion

Our results suggest that the subsidiary R&D and R&D conducted by the MNE for the subsidiary have a different impact on subsidiary productivity performance, and that this crucially depends on the innovation characteristics of the subsidiary’s host country environment. When the host country provides abundant opportunities to source knowledge at the industry’s global technology frontier, the R&D conducted in the MNE network for the subsidiary does not have a notable effect on subsidiary productivity. Instead, investments in local subsidiary R&D significantly improve performance. R&D conducted in the MNE does become relevant for productivity when the host country industry is lagging behind the global technology frontier. This positive effect of R&D investments by the MNE becomes stronger if it is combined with R&D conducted in the subsidiary. Through investments in R&D, subsidiaries develop the capacity to more effectively process and apply advanced MNE knowledge and to combine this with local knowledge. This complementary, reinforcing, effect of the two types of R&D is important: A positive effect of subsidiary R&D in lagging industry environments is only observed if it is combined with a substantial R&D investment conducted by the MNE on behalf of the subsidiary.

Our findings suggest that the traditional view that considers MNEs to focus on exploitation of their home based expertise in foreign markets (Buckley & Casson, 1976; Caves, 1996; Hymer, 1976; Kuemmerle, 1997) applies to subsidiaries in technologically lagging host country environments. In contrast, subsidiaries benefit strongly from R&D in the host country if the country is at the global technology frontier, in line with prior research suggesting that host country knowledge sourcing is more likely to be the objective of local R&D in such environments (Belderbos et al., 2015; Berry, 2015; Cantwell & Janne, 1999; Kafouros et al., 2012; Singh, 2007; Song & Shin, 2008). Hence, the role of local subsidiary knowledge and MNE knowledge in innovation and productivity is contingent on the subsidiary in its host country environment (e.g., Scott-Kennel & Giroud, 2015). In this regard, our study answers to the call by Papanastassiou et al. (2019, p. 648) to examine in more detail the heterogeneous relationship between R&D configurations of MNEs and the geography of innovation.

Our study contributes to the literature on R&D internationalization by MNEs by showing the influence of the host country’s relative technological strength on the performance effects of investments in local R&D and R&D conducted elsewhere in the MNE network, as well as their potential complementarities. Until now, the subsidiary’s host country position in the international technological landscape has been examined in the context of international knowledge flows (Cantwell & Janne, 1999; Singh, 2007), parent MNE performance (Belderbos et al., 2015) and exports (Salomon & Jin, 2008; Smith, 2014). In our paper, we consider this dimension in assessing the role of international R&D configurations—R&D in the focal subsidiary and R&D conducted for the subsidiary in the MNE—in improving subsidiary productivity performance.

We also contribute to the literature that has observed complementarities between different types of R&D but that has mainly focused on relationships between internal and external R&D (e.g., Cassiman & Veugelers, 2006; Phene & Almeida, 2008) by highlighting complementarities between two types of internal R&D. In the context of multinational firms, we highlight the specific conditions under which complementarities are observed—in subsidiaries in lagging industries. This provides nuance to the literature on knowledge flows and R&D within multinational firm that has examined complementarities between intra-firm licensing and affiliate R&D (Belderbos et al., 2008) and affiliate R&D and parent managerial knowledge (Berry, 2015). Our results are consistent with the notion that subsidiaries’ R&D efforts in local innovation contexts increase absorptive capacity and ‘cross-fertilization’ potential with the know-how based on R&D conducted in the MNE, but, importantly, we qualify this relationship and establish the condition that this is only a significant feature of subsidiary R&D in technologically lagging host country environments. It is important to note that this does not mean that no complementarity between subsidiary R&D and MNE conducted elsewhere in the subsidiary exists if the subsidiary operates in an advanced R&D environment at the technology frontier; rather, the productivity benefits are likely to accrue to the parent firm or other subsidiaries of the MNE in a reverse technology transfer logic (e.g., Belderbos et al., 2015; Driffield et al., 2016; Håkanson & Nobel, 2000; Rabbiosi, 2011; Tsang & Yip, 2007; Un & Cuervo-Cazurra, 2008).

The implications for the management of MNEs and their subsidiaries is that it is important to closely monitor and assess the relative strength of the local innovation system compared with the existing knowledge base in the MNE and other locations in which the MNE is active. Subsidiary performance rests on an effective allocation of resources to R&D conduced in the subsidiary and R&D conducted elsewhere in the MNE in line with these relative advantages. Relying on technological know-how and expertise developed in the MNE is not always the best option. Subsidiary R&D mandates should be free to evolve following the dynamics of the local innovation and technological strengths (Asakawa, 2001; Cantwell & Mudambi, 2005). If the MNE does possess most valuable technological assets, managers should be aware that a specific local R&D mandate may still be required to explore new applications of MNE knowledge that can strengthen the subsidiary’s position on the local market. This does imply a strong coordination between the MNE and the subsidiary to coordinate and collaborate on R&D and reap the benefits of complementarity (e.g., Edler et al., 2002; Zeschky et al., 2014). Initiatives to facilitate foreign subsidiaries’ interactions and knowledge transfer across borders within the MNE network may result in simultaneous increases in complementary R&D activities carried out locally by subsidiaries.

Our study is not exempt from limitations, which also suggests potential avenues for further research. First, we note that we do not observe the geographic origin of the R&D conducted by the MNE for the subsidiary. Our results should be interpreted as an average effect of MNE R&D on subsidiary productivity contingent on the technological position of the host country. Detailed information on the type, location and quality of R&D and innovation within the MNE and its network, or information on the home country of the foreign investor, would allow for a more thorough analysis of the mechanisms of knowledge transfer and R&D complementarities. In this regard, the integration of patent data with R&D surveys could open new paths for further research. Second, in our empirical setting we only look at R&D investments dedicated to the focal subsidiary, while there are other sources of knowledge creation and transfer such as technology licensing (Belderbos et al., 2008) and the use of MNE expatriate experts (Berry, 2015). Third, data limitations do not allow us to control very well for the different ways in which subsidiaries forge linkages with local R&D partners in in the local innovation system (Ciabuschi et al., 2014; Isaac et al., 2019; Song et al., 2011; Un & Rodríguez, 2018), which can differentially enhance knowledge sourcing and productivity benefits. Future work could explore the subsidiary’s linkages with the network of local engineers and the establishment of inter-firm collaborations as a further moderator in the relationship between subsidiary R&D investments and productivity. Fourth, our analysis is confined to subsidiaries located in a small and open advanced economy, with industries relatively often close to the technology frontier. Future research could examine the validity of our findings for subsidiaries located in larger countries and could take into account country variation in the strength of the innovation system.

Fifth, we focused on the relationship between subsidiary and MNE R&D with productivity, while the organization of global manufacturing operations in the MNE’s network and related work practices can be an alternative source of productivity advances (e.g., Castellani et al., 2017; Kafouros et al., 2008). Finally, although our data provide unique and detailed insights into R&D investments in the MNE and their foreign affiliates, we did not have access to more recent data. These considerations suggest ample opportunities further consider the intricate role of the configuration of R&D across the MNE network and the resulting performance effects.

Source: Springer

Table 2 shows correlations and descriptive statistics for all the variables used in the second-stage probit model. No high correlations were observed.

Table 2 shows correlations and descriptive statistics for all the variables used in the second-stage probit model. No high correlations were observed.

where pij denotes i’s number of patent applications in subclass j and ni denotes i’s total number of patent applications in each year. Second, we take the natural log of inverse of the above ratio, then, the higher value of it represents more R&D diversification.

where pij denotes i’s number of patent applications in subclass j and ni denotes i’s total number of patent applications in each year. Second, we take the natural log of inverse of the above ratio, then, the higher value of it represents more R&D diversification.